Advantages of trading Derivatives on Forex with

RIF Capital

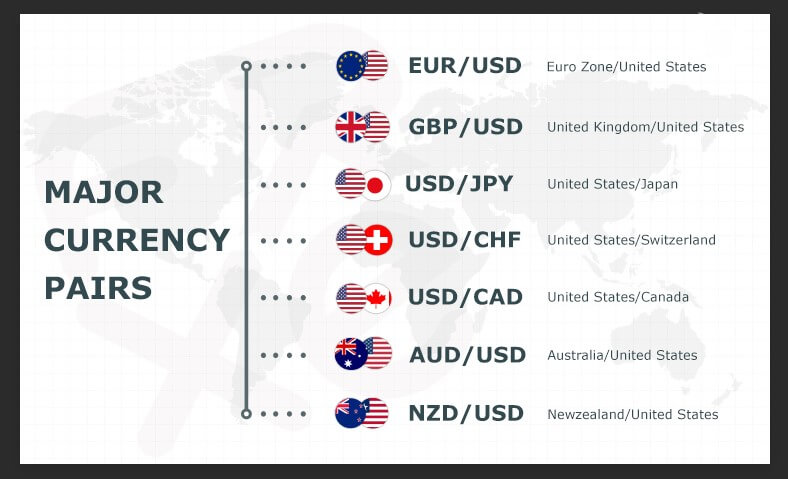

Currency pairs - majors, minors & exotics

Tight spreads and leverage up to 1:1000

Funding methods - NO deposit fees

Superior trading tools

Powerful trading platforms

Dedicated customer support

What is Forex trading?

FX trading is the buying and selling of currencies with the aim of making a profit. Currencies are traded in pairs - the first currency listed in a forex pair is called the 'base' currency while the second currency is called the 'quote' currency.

The EUR/USD (Euro/US Dollar) is the most traded currency pair in the world. The example below involves buying the Euro and selling the US dollar. In other words, the price represents the amount of US dollars that can be exchanged for one Euro.

EUR/USD = 1.2500

The FX market is open 24 hours a day, five days a week and traded online with price quotes changing constantly. This is due to a variety of factors such as interest rates, market factors and geopolitical risks that affect supply and demand for currencies.

As the largest and most-traded financial market in the world, foreign exchange offers ample opportunities for those who want to experience the highest volumes and liquidity.

At RIF Capital we offer Derivatives on Forex on a wide variety of currency pairs with exceptional trading conditions such as tight spreads and fast execution. Open a forex trading account and use our powerful trading platforms and professional tools to trade today’s markets with the advantage of tomorrow’s cutting-edge technology!

Benefits of FX trading

Wide range of FX pairs

High liquidity

Flexible leverage

24-hour trading

Low transaction costs

Forex Trading Marketplace

The current state of the forex trading marketplace positions it as the largest and most liquid global market. This status is attributed to various factors, including the ease of conducting transactions online, advancements in travel, international communication, and modern transportation.

These developments have effectively shrunk the world, facilitating faster and more accessible movement of people, goods, and services. Consequently, the need for currencies to be traded against each other has emerged as a necessity, contributing to the expansion of the forex trading marketplace. This growth is anticipated to persist, fostering a more dynamic, liquid, and responsive market.

Online Forex Trading

A notable and expanding segment within the forex trading market consists of retail foreign exchange traders, individuals engaged in online forex trading primarily for speculative purposes. Their ultimate objective is to profit from currency fluctuations or hedge against unwanted currency risk.

Retail traders typically participate in the forex market through brokers or banks. In this scenario, the broker or bank provides the retail client with a trading account funded in a base currency, usually the local currency of the client's region. This arrangement allows clients to buy and sell currencies both online and over the phone to capitalize on market changes and generate profits.

Forex Trading via a Broker

Engaging in forex trading through a broker, such as CK Markets, offers clients access to real-time pricing in the forex marketplace. Clients are quoted buy and sell prices for various instruments via an online trading platform or phone. This approach grants clients the flexibility to decide when to execute transactions and at what prices, enhancing their control over their trading activities.